SEARCH BLOGS

North Star Mortgage Network Blog – Florida Mortgage Tips & News

Welcome to the North Star Mortgage Network Blog, where Florida homeowners, buyers, and investors come for honest mortgage advice.

Each article is written to help you make smarter financial decisions. Whether you’re exploring loan options, comparing rates, or watching the real estate market, you’ll find simple explanations and practical tips you can use.

At North Star Mortgage Network, we believe in keeping things clear and personal — no jargon, no confusion, just the truth about what’s happening in Florida’s housing and mortgage world.

What You’ll Find on the North Star Mortgage Network Blog

The North Star Mortgage Network Blog covers everything you need to understand the mortgage process in Florida.

You’ll find:

-

Rate updates and Federal Reserve insights.

-

Guides for FHA, VA, USDA, Conventional, and Non-QM loans.

-

Local market trends from Jacksonville, St. Johns, and across Florida.

-

Credit and refinance tips to help you save money.

-

Step-by-step explanations for first-time buyers.

We write every post with one goal — to help you feel informed and confident about your mortgage decisions.

For additional lending and housing resources, visit HUD.gov.

Expert Insights You Can Trust

Our blog is led by Nathan Young, founder and president of North Star Mortgage Network. With over 25 years of experience in Florida lending, Nathan brings real-world knowledge and straight talk to every topic.

We break down complex mortgage topics into easy-to-read articles so you can understand how rates, loan programs, and market changes affect you.

From Jacksonville to Miami, we’ve helped thousands of Floridians buy, refinance, and invest with confidence.

Popular Topics

Here are a few of the topics we cover on the North Star Mortgage Network Blog:

-

FHA and VA loan guidelines made simple.

-

Down payment assistance programs available in Florida.

-

Rate trends and Fed updates that affect your payment.

-

Home equity strategies and refinance opportunities.

-

Tips for real estate investors using DSCR and Non-QM loans.

New posts are added weekly, so check back often for updates.

Why Readers Choose the North Star Mortgage Network Blog

Unlike national mortgage blogs, our content is built specifically for Florida homeowners.

We know the local programs, market conditions, and challenges that borrowers face here. Our advice is based on hands-on experience — not national averages.

When you read our blog, you get information that applies directly to your local market and your financial goals.

Subscribe and Stay Updated

Don’t miss the latest insights from the North Star Mortgage Network Blog.

Sign up for our free newsletter to receive new posts, rate updates, and home loan advice straight to your inbox.

Experts suggest that 2024 will be a good time to refinance your home due to potential drops in mortgage rates, improved credit scores, the opportunity to access cash through equity, lower mortgage payments, the ability to get a better mortgage, the possibility of saving on private mortgage insurance, and the potential for peace of mind…

Experts predict increased activity in the housing market in the first quarter of 2024 due to lower mortgage rates. Despite the usual slow start in winter, the market is expected to gain momentum as spring approaches. Buyers will face low housing supply and increased competition, but housing inventory is expected to increase starting in February.…

The USDA (United States Department of Agriculture) mortgage loan program is a government-backed home loan initiative designed to promote rural development by providing affordable financing options for eligible borrowers in rural and suburban areas. The USDA offers several types of loans, but the most common one is the USDA Rural Development Guaranteed Housing Loan Program.…

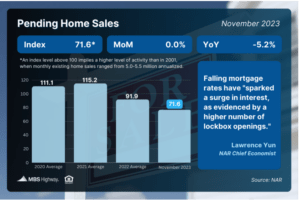

Home Sales “Will Improve in 2024” Home Sales “Will Improve in 2024”. Pending Home Sales were unchanged from October to November, though October’s figures were revised slightly higher according to the National Association of REALTORS (NAR). Sales were also 5.2% below the level reported in November of 2022. This data measures signed contracts on existing…

This follows weeks of mortgage rate declines and listings increases. Homebuying rebound? A report by Redfin, a real estate brokerage, found that US pending homes sales dropped by 4% year-over-year during n the four weeks that ended on December 24. This was the smallest decline seen since March 2022. The Redfin Homebuyer Demand Index saw…

US housing crash – how likely is it? Buyers’ activities based on fear could produce a crisis. Given the mercurial and unpredictable market, it’s almost become fashionable for people to predict a housing crash. Those taking a contrarian view have been all but ridiculed – particularly among those not understanding the intricacies of the market.…

When is the right time to buy a house? With rates dropping and even likely to drop next year, some say it’s time to act In terms of buying a home, the time to make a move is now. That’s what some in the mortgage business are saying on the heels of the Fed’s decision…

This was an increase from the data year-over-year in Florida’s housing market. Florida’s housing market saw more new listings and higher statewide sales prices in November compared to the numbers from the previous year, Florida Realtors’ latest housing data revealed. “November brought some welcome news for Florida homebuyers, as mortgage rates started to ease and…

Mortgage Rates Fall. US mortgage rates declined for the fifth consecutive week and reached a level not seen since June, according to data from the Mortgage Bankers Association (MBA). MBA’s data found that the contract rate on a 30-year fixed mortgage dropped to 6.83% in the week ending on December 15. The rate on five-year…

The pursuit of homeownership is a significant milestone in one’s life. An FHA loan provides a viable path to achieving this dream. Best FHA lenders play a crucial role in facilitating this journey, offering financial solutions and guidance to prospective homeowners. In this comprehensive exploration, we delve into the diverse landscape of FHA loan lenders,…