blog

VA Manual Underwriting: A Path to Approval for Florida Veterans

If you’re a veteran or active-duty service member in Florida and have been told you don’t qualify for a VA loan because of a “Refer” finding or lack of credit history, don’t give up. At North Star Mortgage Network, we specialize in VA manual underwriting, which allows your file to be reviewed by a real…

Read MoreNorth Star Non-QM Loans: Flexible Financing for Non-Traditional Borrowers

At North Star Mortgage Network, we understand that not every borrower fits into a conventional box. That’s why we proudly offer a wide range of Non-QM (Non-Qualified Mortgage) loan programs—designed for self-employed borrowers, real estate investors, foreign nationals, and others with unique income or credit scenarios. What Are North Star Non-QM Loans? Non-QM loans are…

Read MoreTerminating Private Mortgage Insurance: How to Cancel PMI the Right Way

If you’re currently paying private mortgage insurance (PMI), you’re probably wondering when and how you can remove it. At North Star Mortgage Network, we’re often asked about terminating private mortgage insurance—and the truth is, it depends on a few key factors. Whether you’re approaching 80% loan-to-value (LTV) or considering a property value reassessment, here’s everything…

Read MoreUnderstanding Mortgage Recast: What Homeowners Need to Know

If you’ve recently come into a lump sum of money—like a bonus, inheritance, or proceeds from selling another property—and you’re wondering how to put that toward your mortgage, understanding mortgage recast can save you thousands in monthly payments without the hassle of refinancing. At North Star Mortgage Network, we believe in educating our clients so…

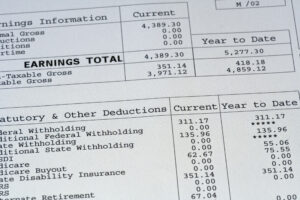

Read MoreUsing a Paystub in Lieu of Final VVOE: What Homebuyers Should Know

If you’re in the final stages of getting a home loan, you may hear your lender talk about using a paystub in lieu of final VVOE. At North Star Mortgage Network, we aim to simplify the mortgage process and help you understand each step. This article explains how your recent paystub can sometimes take the…

Read MoreWhat Is a Verbal Verification of Employment in the Mortgage Process?

When you’re applying for a mortgage, one step that often surprises borrowers is the verbal verification of employment. At North Star Mortgage Network, we believe in educating our clients every step of the way—so let’s break this down simply. Why Lenders Verify Your Employment Before a loan can be finalized, your lender needs to confirm…

Read MoreSmartVest DSCR & STR Loans: Flexible Financing for Long-Term & Short-Term Investment Properties

The SmartVest DSCR & STR program offers tailored financing solutions for experienced real estate investors seeking to purchase or refinance investment properties. This business-purpose loan product evaluates eligibility primarily through Debt Service Coverage Ratio (DSCR), not traditional income verification—making it ideal for those leveraging property cash flow. Why Choose the SmartVest DSCR & STR Program?…

Read MoreHow We Help Clients Close a Mortgage in 30 Days or Less

When it comes to buying a home, speed and certainty matter just as much as rate—and that’s where we shine. At North Star Mortgage Network, we regularly help borrowers close a mortgage in 30 days or less, and we do it without sacrificing service, communication, or pricing. Just yesterday, a borrower came to us after…

Read MoreRenovation Loan Comparison 2025: Key Features

Here’s how these programs compare on important factors like loan size, occupancy eligibility, allowable improvements, and more. Loan Amounts and Property Types HomeStyle® & CHOICERenovation®: Max $806,500 unless county limits are higher. Eligible for primary, second homes, and investment properties. FHA 203(k): Max $498,257 (or $524,225 for cases after Jan 1, 2025). Primary residences only.…

Read MoreManufactured Home Foundation Inspection for FHA, VA, USDA & Conventional Loans

A manufactured home foundation inspection is a required part of the mortgage process when financing a manufactured or mobile home. Whether you’re using an FHA, VA, USDA, or conventional loan, lenders need to confirm the home is on a stable, permanent foundation that complies with HUD (Housing and Urban Development) guidelines and local building codes.…

Read More