How Student Loan Payments Affect Getting a Mortgage

For many Americans, student loans are a reality that follows them well into adulthood. If you’re considering buying a home, you may be wondering how your student loan payments will impact your ability to qualify for a mortgage. The good news? Having student loans doesn’t automatically disqualify you from homeownership. However, they do play a role in your mortgage application process. Let’s break down the key ways student loan payments can affect your mortgage.

1. Debt-to-Income Ratio (DTI)

Lenders use your debt-to-income ratio (DTI) to assess your ability to take on a mortgage. DTI compares your total monthly debt payments (including student loans, credit cards, car loans, etc.) to your gross monthly income.

Formula:

Most lenders prefer a DTI below 43%, though some loan programs allow higher ratios. If your student loan payments are significant, they could push your DTI above acceptable levels, making it harder to qualify for a mortgage.

2. Credit Score Impact

Your credit score plays a crucial role in determining your mortgage eligibility and interest rate. On-time student loan payments can boost your credit score, demonstrating responsible financial behavior. However, missed or late payments can lower your score and make securing a mortgage more difficult or more expensive.

3. Loan Type and Repayment Plan

The type of student loan and repayment plan you have can affect your mortgage application:

- Fixed vs. Income-Driven Repayment (IDR): If you’re on an IDR plan, lenders may use a higher estimated payment rather than your actual payment, which can increase your DTI.

- Deferred Loans: Some lenders count deferred loans in your DTI calculation, assuming a percentage of the total balance as a monthly payment.

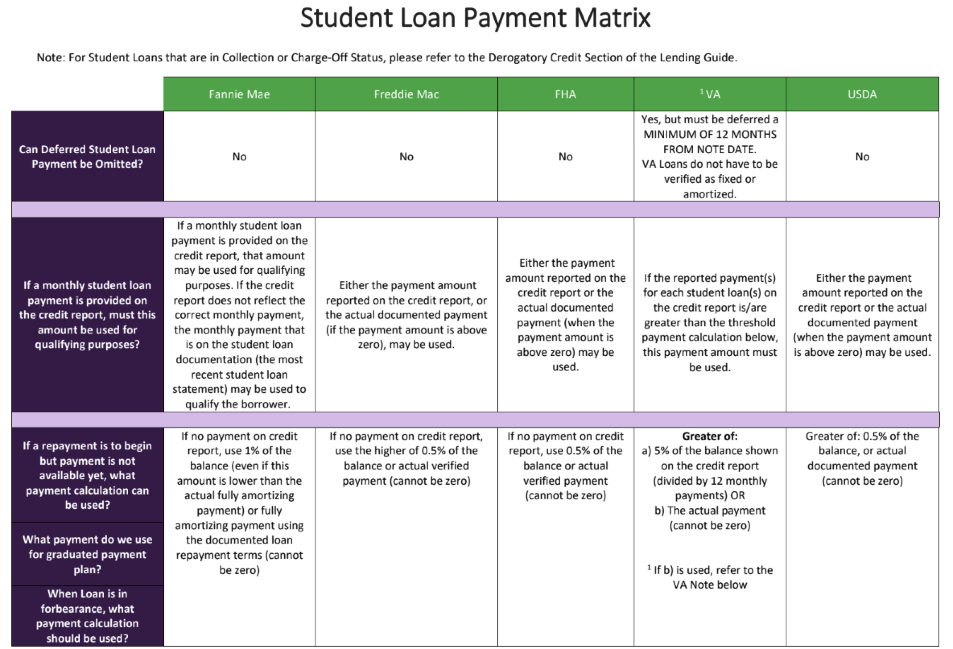

4. Loan Program Considerations

Different mortgage programs have varying approaches to student loan payments:

- Conventional Loans (Fannie Mae & Freddie Mac): May use your actual student loan payment or a percentage of the total balance (typically 1%).

- FHA Loans: Typically use 0.5% of the loan balance if no payment is reported.

- VA Loans: May exclude student loans in deferment longer than 12 months from DTI calculations.

- USDA Loans: Generally count 0.5% of the loan balance toward DTI.

5. Strategies to Improve Mortgage Eligibility

If student loan payments are impacting your ability to qualify for a mortgage, consider these strategies:

- Refinance or Consolidate Loans: Lower your monthly payment to reduce DTI.

- Increase Your Income: Higher income can offset a high DTI.

- Pay Down Debt: Reducing credit card or auto loan balances can free up borrowing power.

- Improve Credit Score: Make timely payments and limit new credit inquiries.

- Consider Loan Programs Wisely: Work with a mortgage professional to find the best loan option based on your student debt situation.

Final Thoughts

While student loan payments can impact your mortgage eligibility, they don’t have to be a roadblock to homeownership. Understanding how lenders evaluate your student debt and taking proactive steps to manage your finances can improve your chances of getting approved for a mortgage. If you have questions about how your student loan payments might affect your homebuying journey, reach out to a mortgage professional who can guide you through your options.

Notes

- VA Only: If the payment(s) reported on the credit report is less than the threshold payment of 5%, in order to count the lower payment, the loan file must

contain a statement from the student loan servicer that reflects the actual loan terms and payment information for each student loan(s). The statement(s) must

be dated within 60 days of the loan closing and may be an electronic copy. It is the lender’s discretion as to whether the credit report should be supplemented

with this information. - Fannie Mae, Freddie Mac, FHA, & VA: The borrower must be eligible or approved, as applicable, for the student loan forgiveness, cancelation, discharge, or

employment-contingent repayment program, and UHM must not be aware of any circumstances that will make the borrower ineligible in the future. Evidence

of eligibility or approval must come from the student loan program or the employer as applicable. - Freddie Mac Only: If the income being used for qualifying matches the income used for the IBRP, then that payment can be used, as long as the income used by

that creditor is documented. - USDA Only: Loan must have already been forgiven, canceled, discharged, or otherwise paid in full to not have a payment. Student loans in a “forgiveness”

plan/program remain the legal responsibility of the applicant until they are released of liability from the creditor. The applicable payment must be included in

the monthly debts. - NOTE FOR ALL PRODUCTS:

a. With all categories EXCEPT IBRP and FNMA, if a payment is not listed on the credit report, evidence of payment(s) documented and utilized with a

credit supplement may be acceptable. FNMA requires documentation from the student loan servicer.

b. If a student loan is sold or transferred to another lender, the payment history and terms of the debt with the new lender must be verified.